michigan sales tax exemption industrial processing

Clarification needed is the person who prepares and files the Certificate of Incorporation with the concerned state. To learn more contact the Michigan Department of Treasury at 517 373-3200.

Sales And Use Tax Regulations Article 3

Young Municipal Center or call 313 224-3035.

. Tax Accounting. After the federal Earned Income Credit is approved complete and submit the MI-1040 form. Please allow up to 24 hours for a sales representative to respond.

Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. Industrial Tube Steel is open Monday thru Friday 8am to 5 pm EST and closed on weekends. To file for a PRE exemption visit the Assessment Division Room 804 Coleman A.

Industrial Tube Steel is open Monday thru Friday 8am to 5 pm EST and closed on weekends. If you are not tax-exempt regretfully we cannot accept your order due to tax reporting. You must own and occupy your home.

Please allow up to 24 hours for a sales representative to respond. It is the Purchasers. Nonprofit Internal Revenue Code Section 501c3 or 501c4 Exempt Organization must provide IRS authorized letter with this form.

With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. Claiming the Michigan Earned Income Credit requires filing a federal 1040 1040A or 1040EZ form. Share per value refers to the stated minimum value and generally doesnt correspond to the actual share value.

If you are not tax-exempt regretfully we cannot accept your order due to tax reporting. The State of Michigan provides an exemption of 18 mills from a portion of the property tax bill for a taxpayers primary residence. We will require your state tax exemption certificate prior to the processing of your order.

Registered agents are responsible for receiving all legal and tax documentation on behalf of the corporation. We will require your state tax exemption certificate prior to the processing of your order. LA - Sales Tax Exemption Certificate R-1020 LA - Certificate of SalesUse Tax Exemption R-1056 LA - Sales Tax Exemption Certificate For Purchases By The Federal Government R-1356 LA - Louisiana Resale Request.

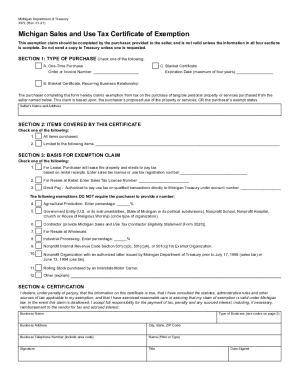

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales And Use Tax Certificate Of Exemption

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Mi Dot 3372 2021 2022 Fill Out Tax Template Online Us Legal Forms

Get And Sign Form 3372 Michigan Sales And Use Tax Certificate Of 2021 2022

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Safety Equipment Exempt From Sales And Use Tax Doeren Mayhew Cpas

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller